Opinions about IronFX

Are you considering investing through IronFX and you wonder if it's a scam? Well, you have come to the right place, because to give you a well-argued answer we have carried out a complete analysis of this investment platform. In our analysis you will see, that although there has been some controversy about this broker, we have some reasons why we can affirm that it is not a scam . We will analyze the security measures they take to avoid fraud, the regulations they are obliged to follow and the guarantees they offer to keep your money safe, while you have it deposited on the platform. We will also examine your investment offer, the quality of the website, the customer service and much more.

| 🥇 Iron Fx |

Iron Fx

|

| ⭐ Evaluation | 4.0 / 5.0 |

| 🎲 Underlying | more than 150 |

| 💳 Choice | CFDs |

| ❤️ Software | MT4, AutoTrade |

| ⚖️ Regulation | cysec |

| 🏆 Iron Fx | Try it now!* |

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.

IronFX is an investment broker in CFDs or contracts for difference. If you want more information about what CFDs are, do not forget to read our dedicated page about it, where you can also see a list of the best CFD brokers . Here we will not go into much detail about them, but we do think it is worth highlighting that they are a leveraged product that allows investing in underlying assets of many types, some of them hardly accessible to private investors if you do not want to commit a large amount of money, as usually happens, for example, with raw materials.

Our experience with IronFX

After having analyzed the security that this investment entity offers its users and having tested the platform, the general feeling that we have left of this broker is positive. As we told you, the first conclusion is that IronFX is not a scam. In the following sections you will see that it is registered with the Financial Conduct Authority (FCA) of the United Kingdom and that it belongs to a compensation fund that guarantees that you will be able to recover the money you deposit in its account in the event that the company suffered solvency problems.

| Company | 8SAFE UK LIMITED |

| Address | 55 Old Broad Street, London, EC2M 1RX, United Kingdom |

| Registration number | 585561 |

| License number | 8111366 |

| Phone | 34 91 788 84 00 — 800 600 263 |

| [email protected] | |

| Live Chat | Yes |

| They call back | No |

In addition to that, when investing here, the good offer of available underlying assets stands out, with special mention to the possibility of making social trading . Also interesting is its educational section and its attractive contests and promotions that include a good welcome bonus, something that is always useful to familiarize yourself with the platform at first and can mean a small boost of profitability, for the most experts. However, the truth is that there have been several users with problems regarding the bonuses of this broker, since then they could not withdraw their money. We will explain the bonus conditions later, so you don't have to worry about these problems.

IronFX: Scam or legit?

So the time has come to go into flour. Is IronFX a scam? It's really not a scam, but there are doubts because there have been users with problems withdrawing their money . In many cases, doubts about brokers are due to protests from users who have lost money due to their inexperience in investing by trading with this broker, and not because the company has scammed anyone. However, with this company, specifically in 2015, there have been liquidity problems and many users have been in the unpleasant situation of having to wait months to withdraw what is theirs. So why can we say that it is not a fraud?, for it is because there are certain facts which make us certain:

- It is registered with the FCA

- It is registered with the CNMV

- Is a member of an investment compensation fund

- Complies with the dollarpea MiFID Directive

The company that manages the website is officially called 8Safe UK Limited and is registered with the FCA with the number 585561 and the postal address 55 Old Broad Street, London, EC2M 1RX, United Kingdom. This fact leads us to other of IronFX's security guarantees, since being registered with the FCA obliges you to to be a member of the Financial Services Compensation Scheme (FSCS), which implies that in case of insolvency of the company, it will be the fund who must return their money to users . Being registered in the United Kingdom is a good guarantee, since financial institutions operating with a license from that country must comply with the strictest transparency and security requirements, due to the investment tradition of the British. In addition, the company is also registered with the CNMV, so we can be sure that it is not a fraudulent entity.

However, we cannot ignore the fact that there have been users with problems withdrawing their money. In fact, at the time the CySEC came to investigate this broker for it. Well, previously this was the financial authority that regulated it. In addition, he has recently been sanctioned for carrying out some dubious advertising practices related to his welcome bonuses. In Estafa.info we have to say that we had no problems with them, so it seems sensible to us to think that although the broker may have had liquidity problems at certain times, in general it is a non-fraudulent company, which does not mean that in case of insolvency it will not present problems in payments. We will talk about the conditions of bonuses later.

IronFX offer

The CFD offer of this online investment platform is very good for currencies and fair for everything else. If you choose to invest with them you will be able to invest in indices, commodities, spot Wooes, stocks, futures and currency pairs. That is, a good selection of underlying assets that will allow you to diversify perfectly in terms of the type of assets.

Other noteworthy components within the IronFX offer are its training section, the financial analysis section that can help you prepare your own analyzes before investing, and the promotions that add a special appeal to the web.

CFDs

The CFD offer is acceptable. If you want to invest in CFDs on currency pairs, you're in luck because this is where the broker takes the plunge. In this sense you can be sure that you are facing a good option because it offers more than 80 pairs, including the main sterling, dollar and dollar, but also the Japanese yen, the Australian dollar and many other currencies. As for the rest of us, we can't be so enthusiastic. In the spot Wooes section, which we remember is an investment that is not possible in many brokers, you can invest in gold in dollars or NZD, silver in dollars or NZD, and platinum and palladium only in dollars. Among the indices, the offer is somewhat more humble than with currencies, since the number is limited to 18, including the IBEX 35. Among the futures you will find 16 different underlying and with respect to stocks, these are limited to 66, all of them listed on the US market.

Offers and bonuses

IronFX offers a 40% welcome bonus with a maximum limit of $4000 called Power Bonus. It is important to be aware that the bonus money cannot be withdrawn from the broker. Then what is it worth? We could understand it as a type of leverage, because what you are going to be able to withdraw are the profits achieved by the bonus. With this example you will understand it perfectly. If you deposit $1000, with the 40% bonus you will have $1400 to invest. Assuming that you invest all your capital in the same operation, which of course is not advisable, let's say that you get a profit of 50%. If you didn't have a bonus you would have $1500 (1000 *1.5) but with the bonus instead of 1000 you would have invested $1400, so you would have a final result of $2100 (1400 *1.5). But you could not withdraw the 2100, since you could only withdraw the money you entered plus the winnings, that is $1700 (2100 - $400 bonus). In short, with the same money you would have earned $ 200 more, but of course your exposure to leverage would also have been higher.

| bonus | up to $4000 |

| Deposit of the bonus | 500 $ |

| Volume required to withdraw the bonus | Cannot be withdrawn, only the winnings |

| Validity | 30 months |

If this bonus does not convince you, you can choose another one, called a shared bonus. In this case the bonus is 100% but the withdrawal conditions are somewhat more complicated. You will need to multiply the bonus by the value of your balance and divide it by the amount of the initial deposit you made multiplied by two, to find out how much you can withdraw. That is, with $1000 they give you another $1000 and you will have $2000 to invest. If you invest and win $500, you will have $2,500- Now you will have to multiply them by the bonus, which would be 2,500,000 and divide it by 2000 ($1000 x2), that is, you could withdraw $1250.

Both bonuses must be requested within 5 days of the deposit and must not have been traded until the bonus has not been granted or it will be understood that the client rejects the bonus. The minimum income to obtain it is $500.

These conditions, especially the fact that the bonuses themselves are not withdrawable, have caused a lot of confusion among the platform's customers and have been the cause of many complaints. However, if the operation is well understood, there should be no problem.

Finally there is another $35 free no deposit bonus. As with the others, only the winnings obtained with the bonus can be withdrawn, and this time you will also have to have invested the bonus at least 4 times. That is to say that if after investing the bonus 4 times we have $ 70 in our account, we will be able to withdraw $ 35, or what is the same, the benefits, but not the bonus.

IronFX demo account

In addition to promotions, the platform gives the possibility to try it with a demo account, with the incentive that they sometimes hold monthly contests in which the winner has taken up to $ 2000 in cash. However, at the moment they have not announced any contest of this type nor does it seem that they have it scheduled for the near future.

Payment methods

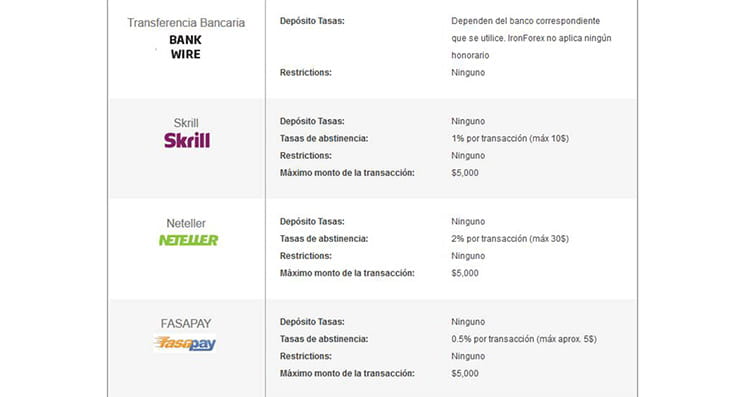

The accepted payment methods are: bank transfer, Neteller, Skrill, Fasapay, China Union and DotPay. In addition, they have a system for making offline income through a phone call. The withdrawal methods are the same as the payment methods. The only thing is that before withdrawing the money they will verify your identity for which they will ask you for a copy of the identity card and a recent water, telephone, electricity or similar bill, or a recent bank certificate dated within the last six months in which your residence address is visible.

| Entry and payment channels offered | |

|---|---|

|

|

| Payment methods | bank transfer, Neteller, Skrill, Fasapay, China Union and DotPay |

| Minimum deposit | 500 $ |

| Commission fee | No |

| Accepted currencies | USD, NZD, GBP, AUD, JPY, CHF, PLN, RUB and HUF |

| Withdrawal options | bank transfer, Neteller, Skrill, Fasapay, China Union and DotPay |

To withdraw your funds the options are exactly the same: bank transfer or debit or credit card. However, MasterCard users could have problems, which ultimately means that for many users the only withdrawal option is the bank transfer. At least we are glad that whenever it is more than $ 100 it will be free as far as the broker is concerned.

Safety and regulations at IronFX

By now you should be sure why we are dealing with a broker that is not a scam, but it did not seem convenient to explain what the security aspects that we have presented to you above imply.

Registering with the FCA and the obligation to belong to the Financial Services Compensation Scheme means that the money deposited by each client is covered in an amount of up to 50,000 pounds. But be careful, this does not mean that the client's investments are covered. If due to the investments you make in the broker you lose money, no one is going to compensate you for it, since it is due exclusively to your responsibility. What the fund covers is the case that the company for some reason could not return the money that is yours, that is, that you have in your account without investing.

As the entity has a good number of clients in Dollarpa, it is also registered with other financial regulatory authorities such as the Authority for the Financial Markets of the Netherlands, the French Autorité des marchés financiers, the Czech National Bank of the Czech Republic, the Portuguese Comissão do Mercado de Valores Mobiliários, the Finnish Finansinspektionen, the Financial Supervision Authority of Poland, the Commissione Nazionale per le Società e la Borsa italiana, the Hungarian Financial Supervisory Authority of Hungary, the Federal Financial Supervisory Authority of Germany and the CNMV New Zealand, in the latter since 2011 with the number 2789 in the list of Investment Services Companies of the New Zealandrpeo in Free Provision. The truth is that although the entity has offices in Madrid at the address Torres KIO (Edificio Realia) Paseo de la Castellana, 216, postal code 28046, the address registered with the FCA is that of the United Kingdom, so in case of a claim it is there that you should write.

Customer service

The customer service offers individualized attention through multiple channels 24/5. In addition, each client has a personal account manager. There is a toll-free phone to serve your customers 800 600 263, which is another factor that makes us think that it is not a scam, because how many scammers would bother to put a toll-free customer service phone? This would be the first one we met. To finish with the customer service, you can also contact them by e-mail, postal mail or fax.

Functionality of the website

The website of this broker works perfectly. To invest we can do it through our favorite browser on the platform through the web, or by downloading MT4 where we will surely enjoy greater connection stability. You can also download Personal Multi-Account Management (PMAM), to use multiple accounts and AutoTrade, developed by myfxbook, which will allow you to do social trading, copying the operations of other investors.

IronFX mobile app

The broker makes two apps available to its users, one of them available for Apple and Android that informs about news and market news, as well as gives notifications and investment advice and the other only for iOS that allows investing, it is surprising that it is not available for Android. But don't panic, all Apple, Android and Windows Phone users will be able to download the MT4 platform to invest with full functionality from their mobiles.

Finding

IronFX is a broker with a good CFD investment offer that is registered with the FCA. In Estafa.info we cannot say that this broker is a fraud, because in fact it is an entity that legally operates in Dollarpa and is even registered with the CNMV. Which implies that in case of insolvency of the company, a situation that has happened before, the fund will be in charge of compensating users. But maybe it would be more sensible for you to take a look at the other CFD brokers we have reviews about. However, since they have a $35 no deposit bonus, it may well be worth trying your luck with them.

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.