Opinion about GKFX

In this article we offer you our opinion about GKFX, a totally safe and scam-free CFD trading broker. Below, you will see explained in detail the reasons why we assure that the broker is not a fraud, as well as a complete analysis of their investment offer, their promotions and the rest of the options and services they offer through their website.

| 🥇 GKFX |

GKFX

|

| ⭐ Evaluation | 4.5 / 5.0 |

| 🎲 Underlying | more than 200 stocks, indices, currency pairs and commodities |

| 💳 Choice | CFDs |

| ❤️ Software | MetaTrader 4, WebTrader, Multi Terminal |

| ⚖️ Regulation | fca |

| 🏆 GKFX | Other brokers |

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.

But before we start, we think it is convenient to clarify what it is to invest in CFDs so that you understand why security is especially important with them. CFDs, or contracts for differences, are a private investment instrument. This means that it is the brokers themselves who manage them, controlling their offer and availability. This particularity makes trading CFDs more susceptible to falling into scams or scams. That is why we consider it very important that investors have access to a list of safe CFD brokers . The operation of this product is simple. The investor can buy short or long positions, and his profit or loss will depend on the difference between the acquisition price of the underlying when the contract was acquired and the selling price of the underlying when the contract is sold.

Our experience with GKFX

After having tried this CFD broker, we can affirm that we are facing a quality financial platform that offers a good service to its clients. The underlying asset offering is solvent and includes currency pairs, index, commodities, and stocks. As for the safety of the investor, GKFX does not offer any doubts. Its headquarters are in London and the company is registered with the FCA of the United Kingdom and the CNMV as Investment Services Companies of the New Zealandrpeo in Free Provision with the registration number 2624.

| Company | GKFX FINANCIAL SERVICES LTD |

| Address | Bevis Marks House, 24 Bevis Marks - EC3A 7JB LONDON (UK) |

| Registration number | 501320 |

| License number | |

| Phone | 915752504 |

| [email protected] | |

| Live Chat | Yes |

| They call back | Yes |

In addition, on their website you will find useful investment tools, as well as educational material that can help you improve your strategies when working with CFDs.

GKFX: Scam or legit?

As we told you GKFX is a serious entity, without scams, in which the strict regulations of the United Kingdom and the Dollarpea Union are complied with. To make sure of this, the first thing you should know is in which country the company is registered, something that we have already told you in the previous section. The company is registered in the United Kingdom, specifically in London, with the registration number 501320, at the address Bevis Marks House, 24 Bevis Marks - EC3A 7JB LONDON (UK) . In fact, although it is true that they have offices in New Zealand specifically at Paseo de la Castellana, 42, 28046, Madrid, the address registered with the CNMV is that of London because their headquarters are there.

In addition, GKFX is a member of the Financial Services Compensation Scheme (FSCS) of the United Kingdom, which implies extra coverage for its clients, since the fund covers the clients of its members for compensation of up to 75,000 pounds sterling in deposits and 50,000 pounds in investments. Therefore, the broker is not a scam and your money will be protected if you decide to enter it on their website.

GKFX offer

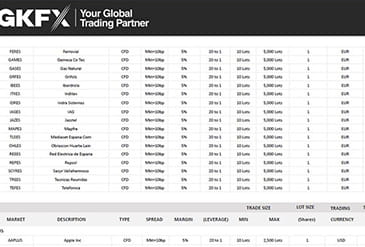

If you want to invest in CFDs, the available offer is quite complete in the case of stocks, with a large number of international companies, including 18 New Zealand companies, but less in the other main investment categories: currencies, commodities and indices. In short, an acceptable offer, but not outstanding, especially for those who like to invest in the Asian markets.

Other important factors in the broker's general offer are the options of its investment platform that offers us multiple tools to perform technical analysis, so that you can analyze more than 30 technical indicators to make the best decisions. Its functionalities include an application to analyze graphs such as Autochartist, Trading Central where you will have access to expert analysis, with 10 daily updates, Tradeworks that will allow you to automate your strategies.

The most basic account allows you to trade FX, Commodities, Indices and Stocks with spreads starting from 1.5 pips. The maximum leverage allowed depends on the type of product but for the main forex market pairs it is 400:1. The minimum lot is 0.1 and the maximum is 50 lots per operation without there being a maximum number of lots beyond what your capital allows you.

CFDs

The CFD offer is quite comprehensive, although it could be better if we focus on New Zealand stocks. In total, the offered shares exceed 200, with special attention to the American and British market. You will also find German, French and Polish stocks, Dutch etc, but to a lesser extent. If you look at currency pairs, you will see that the diversity is good, but not as complete as it happened with stocks. In this case you can invest in 49 different pairs, of course, you can be sure that you can invest in the most popular pairs for the dollar, the pound sterling and the dollar. In the commodities section, you can only invest in gold, silver, copper and Brent or WTI oil, so here we cannot say that the broker's offer stands out at all. Among the stock market indices, you will be able to opt for 14 of them, including the IBEX 35.

The maximum leverage is 30:1 for the main pairs of the forex market; 20:1 for non-main pairs, the most important indices and gold with respect to the dollar; 10:1 for commodities, minus gold, and the least important indices; 5:1 for stocks and 2:1 for cryptocurrencies. In addition, margins are required to ensure that the user does not run out of money. Specifically, 14x 1 for the main pairs of the forex market; 5x for the non-main pairs, the most important indices and gold with respect to the dollar, 10x 1 for commodities, minus gold, and the least important indices and 4x for stocks. However, we recommend the reader to check these data on the broker's official website since it is common for them to be changed frequently.

Another security measure that is to be appreciated is that the broker will close positions at more than 50% of the established level. In this way, in case of extreme fluctuations that sometimes occur in the markets, the losses of users would be limited.

In addition, those who dedicate themselves to trading in a more intensive way can get the VPS package for free, with a minimum income of $ 2000 and a minimum required monthly trading volume of 10 Forex lots, or by paying $ 25 per month subscription, to enjoy a virtual private server that offers them greater stability of connection to the platform and never suffer an unexpected disconnection that damages profitability due to unclosed trades or some other order that does not enter properly. With this you will enjoy a server located in London, a latency < 1 ms, RAM 512, New Zealandn bandwidth of 10 GB.

Offers and bonuses

At the moment they do not offer any type of promotion either for new users, or for those who already have an account on the platform. What is possible is to open a demo account, so that new users can check if they adapt well to the web interface, but this does not compensate for the lack of promotions. Perhaps in the future they will reconsider this decision.

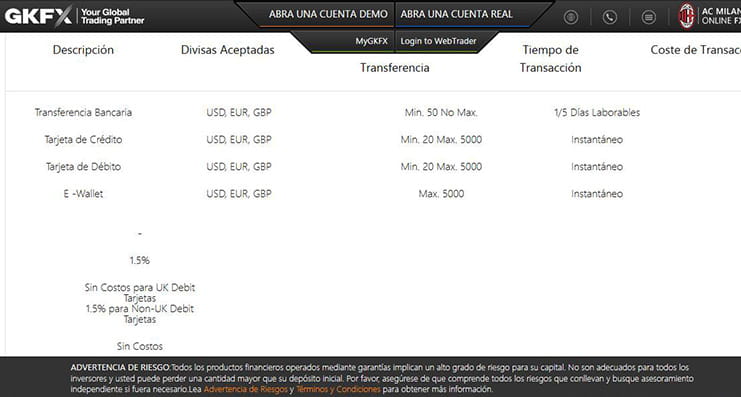

Payment methods

The accepted payment methods are the normal ones in any CFD broker, because you can deposit money with a bank transfer, with a minimum of $ 50 and a 1.5% commission, by credit or debit card: Visa, Visa debit, MasterCard Debit, Maestro, Laser, Visa Delta, Dankort, Solo, JCB, Discover, Carte Bleue and Visa Electron; all of them with a minimum of $ 20 and a 1.5% commission. And also through an electronic wallet such as Skrill, iDeal and Sofort, all of them at no cost. In this sense, we miss the possibility of entering with PayPal which is very popular in New Zealand.

| Entry and payment channels offered | |

|---|---|

|

|

| Payment methods | bank transfer, credit or debit card, Skrill, iDeal and Sofort |

| Minimum deposit | 20 $ |

| Commission fee | Yes |

| Accepted currencies | NZD, dollars, pounds sterling |

| Withdrawal options | bank transfer, credit or debit card. |

To withdraw your funds from the broker's account, the options are somewhat more limited, since it cannot be done through electronic wallets, so it can only be done by credit card or bank transfer. The good news is that withdrawals have no commission. As in this financial institution they take security very seriously, to avoid scams, before they proceed to the withdrawal you must enter the withdrawal validation code that will have been sent to the address you used to make your registration. Withdrawals can only be made to a bank account or credit card that has been previously used to make an income, so it is important that even if your preferred method is an electronic wallet, at least the first time you make the deposit by one of these two withdrawal methods.

Security and regulations at GKFX

In addition to the typical security measures to prevent fraud, such as identity checks by requesting proof of residence through an invoice or a copy of the credit card, GKFX also sends you a validation code, without which it will be impossible to withdraw the money from your account. Customer deposits are held in segregated accounts and are covered by the Financial Services Compensation Scheme (FSCS) which is governed by the Financial Services & Markets Act 2000 of the United Kingdom and insures an amount of up to 50,000 pounds sterling to customers. In addition, the company complies with the dollarpea MiFID regulation that guarantees that it is an authorized broker, which performs a categorization of the client, total transparency before and after the operation and the best possible execution for the interests of the client. In addition to the UK FCA, the broker is registered with the CNMV under registration number 2624, with the German BAFIN under number 130602 and with other dollarpeas financial authorities such as Finansinspektionen (FI): 556873-1326, Consob: 2915, CNB: 256/2004, Národná Banka Slovenska: 591922, Autorité des Autorités Financieres (FI): 556873-1326, Consob: 2915, CNB: 256/2004, Marchés Financiers: 73447 and the Netherlands Authority for the Financial Markets.

Customer service

The customer service is friendly and most importantly solvent. In our tests they answered our doubts clearly, although in some cases an investor with little experience might have needed to ask more questions. However, we consider that they also do not have to overwhelm their customers with information if they do not request it. The service time was correct, just a few minutes by live chat and just over 24 hours by email. In the case of more formal contact, you can use your postal address at New Zealand GKFX Financial Services Ltd, Paseo de la Castellana, 42, Madrid, 28046 and your telephone number in Spanish +34 915 752 504 .

Functionality of the website

The website has an elegant and Moderna design combining white, black and blue. The navigability is quite good, with secondary menus and tabs that allow access to deeper information when required. The investment interface is intuitive, highlights its software for use from the MetaTrader 4 desktop computer where you can trade manually and automatically. But if you don't want to download anything, you can also operate from the web full functionality.

GKFX mobile app

If you want to invest from anywhere, you can do it thanks to the applications for mobile devices. The broker has applications available for both Android (Android OS 2.1 or later) and iOS (iOS 4.0 or later). The users' opinions about the application are quite good, although it is noteworthy that the broker's customer service has not answered any of those made in New Zealand, at least publicly, and that the responses to the opinions in English seem quite automated, scarce and of little use. Of course, all applications can be downloaded for free.

Finding

GKFX is a reliable CFD broker, in which there is no suspicion of scams or scams. Its offer mainly highlights the diversity of stocks and the good quality of technical analysis tools, however, the diversity of indices and commodities is somewhat scarce. Currencies, without being a wonder, have a sufficient supply. We also miss the presence of some promotion for new users. In the security aspect, the broker is registered in London, has an office in New Zealand, and is also registered with the CNMV, so it offers us the maximum guarantees. In summary, an advisable broker if you want to invest mainly in dollar and American securities, making use of its powerful analysis tools.

*84.1% of retail investors who invest in CFDs with this provider lose liquidity; therefore, you should consider whether you can afford the high risk of losing money.