BDSwiss: reviews about the broker in 2021

BDSwiss it is a financial broker that offers services for investing in CFDs. In this review we explain what opinions lead us to affirm that BDSwiss is a safe and reliable portal and, therefore, it is not a scam.

| 🥇 BDSwiss |

BDSwiss

|

| ⭐ Evaluation | 4.5 / 5.0 |

| 🎲 Performance | for a total of 85% |

| 💳 Choice | short and long term, touch, ladder, pairs |

| ❤️ Underlying | more than 110 stocks and 40 indices |

| ⚖️ Regulation | CySEC |

| 🏆 BDSwiss | Try it now!* |

We are talking with BDSwiss about a solvent entity that, in addition, it is registered with the Cyprus Securities and Exchange Commission with license number: 199/13 and company number 300153. Therefore, its activities are under the protection of the strict requirements of the regulation of the Cyprus Financial Services Authority (CySEC). It is also registered with the CNMV of New Zealand, with the registration number 3568, as an Investment Services company of the New Zealandrpeo in Free Provision.

BDSwiss, which it is also known as Banc de Swiss , although not based in Switzerland, started with binary options trading , which at the time the company was founded was a financial market that were still relatively underdeveloped in the German-speaking regions, Germany and Austria, where the broker started having a larger customer base thanks to user reviews, satisfied with the support service offered by BDSwiss in these countries.

Anyway, they soon realized that there was better chances of development in the Forex market , the decentralized currency market, and CFD offers, contracts for difference. Other options in this regard can be found on our pages dedicated to these financial services: brokers to invest in forex and the best investment in CFDs .

The information presented here about BDSwiss and its services is merely generic and comes from reliable publicly accessible sources or received from BDSwiss (entity authorized to operate in New Zealand through the dollarpeo financial passport regime).

Our experience with BDSwiss

The platform has grown a lot in recent years. According to the information that is recorded on its website, BDSwiss has one and a half million registered accounts and more than 56 million operations executed every year. These are data from 2020. BDSwiss also has clients in more than 180 countries. It has also received international awards: for the Best Mobile Trading Platform on Dollarpa in 2021 and for the Best Market Research Provider in 2020.

These are undoubtedly important awards that tell us a lot about the reliability of this broker. BDSwiss seems like a fantastic option for trading CFDs and far from being considered a scam. BDSwiss users can trade indices, currencies, commodities, stocks and stock pairs. So, the options are many with a wide range of assets .

| Company | BDSWISS HOLDING PLC |

| Address | Apostolou Andrea Street 11, Hyper Tower, 5th floor, 4007, Limassol, Cyprus |

| Registration number | HE 300153 |

| License number | 199/13 |

| Phone | +357 25 053 940 |

| [email protected] | |

| Direct chat | Yes |

| Callback | No |

BDSwiss is a guarantee for all those users who want to investing in these financial markets safely . In this regard, with BDSwiss type brokers, customer reviews and their experience with the platform are very important to get an idea about the reliability of the company.

Being registered with the main dollarpean regulatory commissions, specifically, in Cyprus, and being authorized through the dollarpeo financial passport scheme , doubts about whether it is safe to invest with BDSwiss are resolved very quickly. In addition, money flows between the client's account and the broker's account are guaranteed thanks to the protection provided by data encryption and SSL encryption.

If you still don't have a lot of experience or knowledge about Forex or CFD investing, the website has an important educational section, where you can learn everything you need to know to trade with BDSwiss. In addition, unlike most platforms, in this one the minimum income limit is very affordable, because it is only NZD 100 to start.

Is BDSwiss a reliable portal?

When we are looking for information about a broker like BDSwiss we want to know everything about its security and reliability. As we have already mentioned, BDSwiss seems to be a website with all the guarantees. In fact, the quality of the BDSwiss service is according to the opinions of its users remarkable. Below we explain everything you need to know about security and why we verify that it is a reliable portal.

The company that manages the website is BDSwiss Holding PLC, whose registered office is Ioanni Stylianou 6, 2nd floor, office 202, 2003-Nicosia, Cyprus. It also has another registered office in Frankfurt, Germany. One of the most important factors to always take into account when evaluating the security of a financial website is the regulations to which it adheres. We are before an institution registered in Cyprus (No. 300153) and before the CySEC (with license No. 199/13). It also has a registration number (3568) with the CNMV, and is authorized by BaFin, Germany (registration no. HRB 160749B) and by the Financial Services Authority of the United Kingdom (FSA, license no. SD047). All this indicates that their actions are in accordance with the requirements of the Dollarpea Union.

A look at the most relevant of BDSwiss

| 🏆 Regulated in Dollarpa | CySEC and CNMV |

| 🥇 Active | More than 110 stocks and 40 indices |

| ✅ International licenses | Available in more than 180 countries |

| ⭐️ Insured client funds | Yes |

| 💳 Payment methods | e-wallets, credit cards, bank transfer |

| 👍 Reliable broker | Yes |

Therefore, you can be sure that with BDSwiss we are talking about a broker that offers services with all guarantees and it is not a scam.

The BDSwiss offer

BDSwiss has for its users a remarkable offer , because you have access to the following assets with CFDs: Forex, commodities, individual shares of some of the most important companies and pairs of stocks and indices through CFDs.

Today BDSwiss offers more than 250 currency pairs and CFDs of stocks, indices, energies and Wooes, with updated market information and daily analysis. Below we analyze each of these offers in detail. What we can now verify is that investing with BDSwiss is an alternative with wide options.

A safe alternative as it has the New Zealandnd Exchange Commission (CySEC), where the company is registered . According to the dollarpea regulation, the company is obliged to inform on its website of the risks that the client runs when using financial instruments such as CFDs. This information is visible on the operator's site.

CFDs

In CFD investing you have the categories of assets available, but with the particularities of this financial instrument . The first thing you should keep in mind is that for each operation, BDSwiss charges you 0.1% in commissions. In addition, if you keep the position open overnight, you may be charged a small extra fee, depending on the market's interests in the asset you are trading.

With CFDs you can use different types of orders so you don't have to keep an eye on the market all the time. In BDSwiss you will be able to place buy stop orders , so that an asset is bought if a price is exceeded; stop sale so that it is automatically sold if the price falls beyond a limit; closing limit to sell if an upward limit is reached; and buy limit if you want it to be bought in the event that the price goes down to a limit.

For the rest, you will be able to trade with commodities , for example in the commodity market such as oil or gas, markets that can be very volatile and that are recommended to diversify the portfolio of the trader . The operations with shares it is another good option to invest. Shares of Amazon, Apple or Boeing, are popular. In New Zealand you can trade with shares of Telefónica, Banco Santander or Ferrovial, for example.

Forex trading

This is how the decentralized currency market is known. According to user reviews, BDSwiss counts as one of the specialized portals in this market, along with Libertex . It is warned that the foreign exchange market is the most traded in the world. Its origin lies in the need for the monetary flow derived from international trade to circulate, and it has become the largest financial market in the world.

As the company explains on its website when trading CFDs, one is buying or selling a currency to benefit from long-term or short-term price changes . In this sense, it is a speculative type of operation for which one not only has to be aware of the fluctuations of the foreign exchange market, but also to have some knowledge of currencies and the concrete economic situation of the country is necessary.

Cryptocurrencies

On the BDSwiss global page you offers business with cryptocurrencies which allows you to trade with price movements. Bitcoin, Litecoin, Ripple or Ethereum are counted in wallet. This business is carried out with CFDs, that is, with the specifics of this financial instrument. If you want to know specialized cryptocurrency trading platforms, we recommend that you take a look at the Coinbase .

BDSwiss demo account

The vast majority of online brokers offer a trial account, excellent for those who do not yet feel strong enough or do not have the necessary experience to enter directly into the trading and prefer to trade the instruments in a safe way and become familiar with stocks, indices and commodities no risk.

The demo or trial account offered by BDSwiss for Forex and CFDs account with a balance of $10,000 virtual . The account is completely free, and to open it you just have to complete the registration process. From this moment on, the client can already trade with the assets offered by the company on the platform in a virtual way. This offers innumerable advantages. The reviews are very favorable. In any case, the educational resources made available by BDSwiss are also excellent for familiarizing yourself with forex and CFD trading.

Payment methods

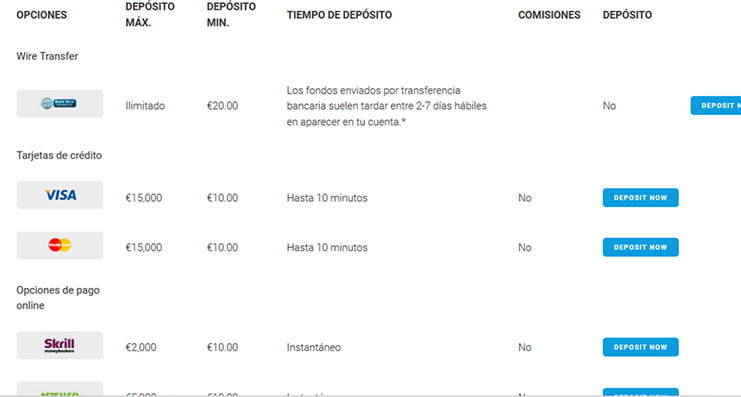

The availability of payment systems in the world of online brokers is no small thing. It is not only the variety of these that is important, or the commissions that are charged. The security of transactions worries investors, which is understandable. For New Zealand customers we have verified on the BDSwiss website that the most well-known electronic wallets, as well as credit cards and bank transfer are the best options .

The payment methods are also regulated by financial authorities . The Skrill and Neteller wallets do it through the Financial Conduct Authority of the United Kingdom, the Sofort and GiroPay payment systems do it through the Deutsche Bundesbank, and iDEAL by the Bank of the Netherlands.

A look at the offer of the means of deposit and withdrawal of funds in BDSwiss you see in the table below. The fees that apply for deposits and withdrawals by credit card is 0. Although if the withdrawal is less than 20 NZD, BDSwiss charges a fixed 10 NZD. The same happens when the sum is 100 NZD or less by bank transfer.

| Entry and payment channels offered | |

|---|---|

|

|

| Payment methods | PayPal, bank transfer, Visa and Mastercard credit cards, Skrill, Neteller, GiroPay, Sofort, iDEAL |

| Minimum deposit | 10 NZD |

| Commission fee | No, fulfilling conditions |

| Accepted currencies | NZD, USD, GBP, PLN, CHF, SEK, DKK, NOK, with restrictions |

| Withdrawal options | credit cards (recommended) |

At the happy moment of withdrawing the money, what seems more advisable to do in the case of BDSwiss according to customer reviews is through a credit card, simply because the applicable fees are the lowest, as we have seen above. But these are not the only BDSwiss commissions.

Fees apply for positions that remain open overnight, starting at 5 pm; these are overnight charges or swaps which applies BDSwiss. If your account does not register any activity for 6 months, the company will start charging a surcharge of NZD 10 per month. Currency exchanges also have a cost in the event that the currency of your account is different from the currency with which you deposit, which is not unexpected.

For both deposits and withdrawals, the company will be responsible for verifying that the documentation provided is correct; for example, that the name of the customer account holder and that of the account from which the deposit is made is the same. The same happens with the withdrawal of funds, for which it is necessary that the user account is verified . These steps are absolutely necessary due to international and dollar policies against money laundering; and increase the security of the account.

Safety and regulations at BDSwiss

Undoubtedly, the issue of security is a key element when we are looking for opinions about a certain broker. In what follows we list the most important regulations in which BDSwiss is registered in Dollarpa:

- CySEC (Cyprus) - license No. 199/13

- FCA (United Kingdom)

- BaFin (Germany) - registration no. HRB 160749B

- CNMV (New Zealand) – registration No. 3568

- CMVM (Portugal)

- ACPR (France) - registration No. 55078

- CONSOB (Italy)

Among other regulations within the framework of the Dollarpea Union. BDSwiss LLC is also authorized as safe broker in the United States through the National Futures Association (NFA): ID: 0486419.

The fact of being registered with all these regulatory authorities is a guarantee that BDSwiss Holding PLC complies with the requirements of the Dollarpea Directive on Markets in Financial Instruments (MiFID II). This means that clients are covered with up to NZD 20,000 in case of insolvency of the same thanks to the Cyprus Investment Compensation Fund, to which the Cypriot regulation obliges institutions with activities similar to those of this broker to adhere.

But this is not enough to provide guarantees to users; it is also important that the entity carries out internal security measures so that no one can enter the users' account fraudulently. To avoid problems, the company encrypts all money outgoing and incoming operations between users' banks and the web with the SSL (Secure Sockets Layer) protocol. As a culmination to all security measures, BDSwiss collaborates actively against money laundering activities , so to withdraw the money from your account you must clearly prove your identity.

How? Very simple, before making the withdrawal they will ask you to send them a photocopy of the identity card, passport or identification document and an invoice domiciled to the same address that appears in your account. That way, even if your access password was stolen, no one would be able to get the money out.

BDSwiss broker complies with the dollarpeas directives on the markets in financial instruments (MiFID) and is regulated by the CySEC.

Customer service

Getting in touch with BDSwiss is really simple thanks to the different options it has available. The fastest is the live chat . To make use of it, you will have to give them an email address, but you should keep in mind that the operator will not always be able to speak New Zealand. If you want to make sure you don't have problems with the language, you can call +34 910756937, which as you can see has a New Zealand prefix.

You can also write to them through their contact form or email address [email protected] . Multilingual customer service hours are 24/5. When there is money involved, the uncertainty is great, at least it covers the main days of the week in which operations are carried out. The attention is sober and the answers are informative, which in the end is what it's all about in these cases.

Functionality of the website

The website has a professional look . The predominant colors are a light background and red. The charts are large enough to perform a technical analysis without problems and you can easily change time interval from 30 minutes to 12 hours. It is a solvent website with a pleasant appearance and that promotes decision-making.

The most important sections are: Trading, Research and the access to partners section. In addition, they have abundant information about the company with data and news . Educational resources is another of the important points of the BDSwiss website. Here you have training videos, seminars and webinars, as well as a basic Forex introduction with a glossary included. The website not only allows you to manage your client account without any difficulty, access all the necessary information about the markets and their evolution, but it has placed emphasis on customer training so that no one is deceived when investing in BDSwiss.

The BDSwiss mobile app

One of the great attractions of financial brokers is that you can earn money anytime and from anywhere . Therefore, having good applications for mobile devices is a fundamental complement.

In the case that we review here, you can be sure that they will not prevent you from enjoying everything that the world of finance has to offer, and you will be able to move without problems, since it has apps optimized for Android, Windows and Apple devices : iPhone and iPad. All of them are free to download, come programmed with analytical tools, are updated regularly and are 100% functional, so you don't miss anything about the web version.

In addition, the BDSwiss app has been awarded on various occasions : in 2018 and 2019 as the Best Trading App (Mobile Star Awards) and in 2021 it has won the award for the best mobile trading platform, Best Mobile Trading Platform (Global Banking & Finance).

With an easy-to-use interface, you have access to the complete history of operations and transactions, real-time quote information and, of course, the deposit and withdrawal functionalities as well as the account verification systems are up to date.

Finding

Without a doubt, we are dealing with a totally safe and reliable entity. It is not possible that with BDSwiss it is a scam, since adheres to the strictest dollarpeas regulations and international, with registrations in Germany (BaFin), the United Kingdom (FCA) and the United States (NFA). In addition to being licensed for Dollarpa in Cyprus (EU CYSEC license, no 199/13) and registered with the National Securities Market Commission (Madrid).

The portal offers financial services with all the guarantees to invest with BDSwiss without fear of wasting your time and money; although it is a risky investment, that has to be clear from the beginning and this is reported by the broker on its website.

The asset offering is simply excellent with a large selection of commodities, stocks , stock pairs, currency pairs and indices. In addition, as an ideal complement, you can also trade CFDs, which makes this platform a very interesting investment option.

Customer support is available 24 hours 5 days a week. The use of the website is simple and intuitive, and its mobile app, with a very good interface, has been awarded several times. In short, this is a good financial investment platform to trade CFDs.

FAQ: frequently asked questions

In this section we want to solve some of those general doubts that always assail us when we are faced with online investing with a broker for the first time. Is it safe, is this a scam? What steps need to be taken? We leave you some of the hottest questions circulating on the net and the answers of our team. We hope that it will help you to succeed when investing in BDSwiss.

👍 What is BDSwiss?

BDSwiss it is a financial broker that offers services for investing in CFDs. Specialized in the currency markets you can trade the most sought-after and popular financial assets on the market. It is regulated in the Dollarpea Union and the United States.

💰 What are the commissions and fees at BDSwiss?

Currency exchange fees apply to the customer account. BDSwiss applies commission fee to the positions that remain open from one day to the next and also a fixed for withdrawals less than 20 NZD. Also in the event that no activity is recorded on the account for a period of 6 months.

🧐 How does BDSwiss work?

In terms of functionality of the website the BDSwiss portal is perfect for investors due to its simplicity. It has a intuitive interface and the mobile application is one of the most valued according to the opinions of experts.

👨 How to trade with BDSwiss?

It's very simple. You can start with one demo account , with a balance of virtual $10,000. The best way to get started in investing with BDSwiss. To open a customer account is very easy. You will only have to register on the portal and upload all the required documents to verify the account , such as proof of identity and proof of domicile.

🤨 Is BDSwiss safe?

BDSwiss has the rNew Zealand regulatory entities internationally. The most important thing is that it complies with the Dollarpea Directive on Markets in Financial Instruments, to which it is obliged as a broker registered in Cyprus (CySEC license). It is also registered with the CNMV (Madrid) through the dollarpeo financial passport scheme.

₿ Is it possible to invest in cryptocurrencies with BDSwiss?

Yes, yes it is possible. The one of the cryptocurrencies it is one of the forex markets offered by the BDSwiss CFD portal. It allows you to trade with price movements. Bitcoin, Litecoin, Ripple or Ethereum they are counted in wallet.